Singapore’s new climate disclosure requirements will make it compulsory for many companies to provide information on climate-related risks and governance. How can credit insurers leverage this to improve their underwriting processes?

Despite being the smallest country in Southeast Asia and accounting for only about 0.1% of global emissions, Singapore is actively engaging in efforts to mitigate climate change, as laid out in its Singapore Green Plan 2030, which aims to achieve net-zero by 2050 in line with the Paris Agreement.

Initiatives under the plan include developing new parks, planting more trees, reducing waste and water consumption, encouraging green commuting through electric buses, developing the public transportation network, and transitioning to green energy, infrastructure and buildings.

The Singapore Government also requires firms to disclose climate-related information for sustainability reporting and accountability. From FY2025, it will be compulsory for listed companies in Singapore to make climate-related disclosures that align with local reporting standards and the International Sustainability Standards Board. From FY2027, non-listed large companies with revenues of up to SGD 1 billion and total assets of SGD 500 million must also comply.

These disclosures pertain to Scope 1 and Scope 2 emissions, defined as direct emissions such as manufacturing plant or corporate vehicles, and indirect emissions such as from the acquisition of electricity, respectively.

From FY2026, listed companies must also disclose Scope 3 emissions, which are indirect emissions from entities both above and below the company in its value chain.

In disclosing these details, Singaporean companies must also reveal how climate change presents risks to their business, how these are taken into account in their business strategy and activity, and their efforts to mitigate risks through their governance frameworks.

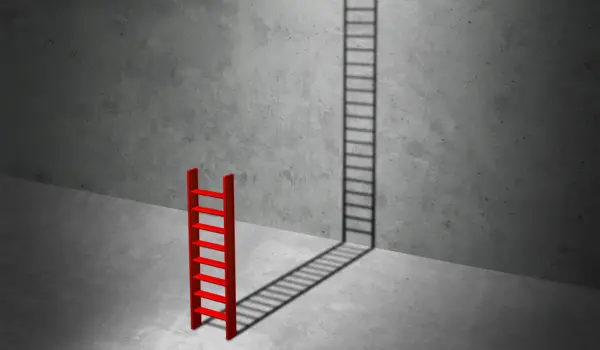

These disclosure requirements present an opportunity for credit risk underwriters to be better informed and access climate-risk-related information when assessing a company’s physical risk and transition risk, as outlined in Tinubu’s recent article – Evaluating Credit Risk in the Face of Climate Challenges. A climate-conscious lens could also be applied to the classic credit analysis factors in determining a company’s creditworthiness, as outlined below.

Profitability

Climate-related events could impact a company’s profitability through both revenue (such as supply of commodities due to flood or drought) and costs (such as operational stoppages due to severe rain), depending on the product/service and industry in which a company operates. In addition to physical risks, demand and sales volumes may also be impacted by transition risk if a company sources its products in an unsustainable way or disregards the environmental impact.

Liquidity

Liquidity (the availability of cash and the speed at which a company can obtain cash from converting assets) could be impacted by climate change. Examples include:

- Selling investments in certain companies may be impacted by the activities those companies engage in and their level of exposure to transition risk.

- Selling fixed assets, where those assets are subject to substantial physical risk from climate change.

- Converting short-term assets such as inventories and trade receivables, as outlined below.

Operational efficiency

Also related to liquidity, operational efficiency is the time a company takes to acquire inventories/products and receive cash from sales, minus the time it takes to repay its suppliers. These short-term cash movements are important considerations in a company’s creditworthiness.

Climate-related challenges could pose physical risks to inventories, for example by being destroyed in extreme weather events such as heat waves, in turn affecting its value and saleability.

Trade receivables could also be subject to transition risks, as customers who have obtained goods deemed obsolete by climate change may be less able or willing to pay. These, in turn, would affect the company’s ability to repay its suppliers as cash is tied up in inventories or trade receivable accounts.

Indebtedness

Companies could borrow for a variety of reasons, such as to meet short-term working capital requirements or to finance the purchase of a fixed asset. In addition to being exposed to physical risks such as damages to the financed asset (which will then affect the ability of the company to generate cash flow from the asset to repay the loan), banks could also impose some financial covenants or collateral on these loans that could be difficult to maintain, for example in the event of a price drop due to climate-related events. If such financial covenants are breached, banks reserve the right to recall the loans, putting a company in financial distress if it cannot repay the loan immediately. This could have a domino effect on other lenders or credit insurers that are exposed to the company and undermine the buyer’s creditworthiness.

The need for a holistic approach to climate risks in credit insurance

While the global credit insurance industry currently lacks a structured approach to assessing climate-related risks, these considerations demonstrate how credit risk underwriters could approach climate risk in the future. Although Singapore has taken positive steps towards sustainability and climate-related reporting in listed and larger companies, a more informal approach, such as via desktop research, would be needed for those companies that do not have the same disclosure requirements, to support more informed decision-making in credit risk underwriting and portfolio management.

/Blog%20authors/Weiling%20LIN%20-%20Tinubu%20Square%20(2)WEBP.webp)

/Blog%20authors/Gladys%20TA.webp)

/Blog%20authors/Benjamin%20Le%20Forestier.webp)